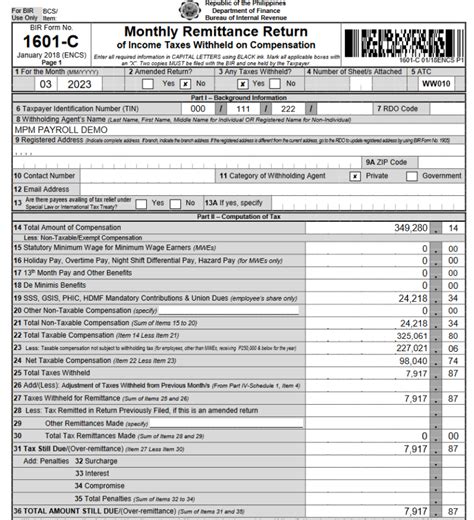

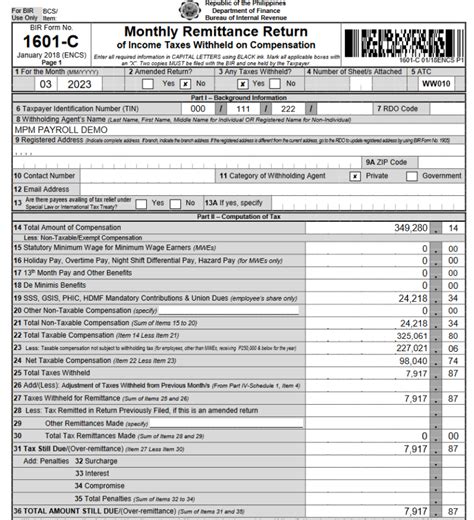

what is 1601c|BIR Form No. 1601 : Manila Less: Taxable compensation not subject to withholding tax (for employees, other than MWEs, receiving P250,000 and below for the year) 24. Net Taxable Compensation. Cinema movie schedule in Robinsons Place North Tacloban. Movies TV Food & Drink Shops & Services. Tickets Menu. . Glorietta Robinsons Galleria South SM Aura Premier SM Mall of Asia SM North EDSA. . Movies Now Showing Upcoming Movies Schedules Streaming Soon Cinemas Near You. Movies. Robinsons Place North Tacloban.

PH0 · Use BIR Form 1601

PH1 · Generating BIR Form 1601

PH2 · Form 1601

PH3 · Downloadables

PH4 · Did You Know You Can File BIR Form 1601C via Taxumo?

PH5 · BIR Form No. 1601C

PH6 · BIR Form No. 1601

PH7 · BIR Form 1601C: Purpose and Guidelines in the Philippines

PH8 · BIR Form 1601C

PH9 · Adding Employees and Compensations for 1601C

MrDeepFakes has all your celebrity deepfake porn videos and fake celeb nude photos. Come check out your favorite Hollywood or Bollywood actresses, Kpop idols, YouTubers and more! . Ivana Alawi Ivana Alawi. 3. 3. 478134. Subscribe 61. Tags: SD; model; . This is why deepfakes are so popular! Deepfake, or "Deep Fake" is a term used to .

what is 1601c*******BIR Form No. 1601-C Monthly Remittance Return of Income Taxes Withheld on Compensation. Guidelines and Instructions. Who Shall File. This return shall be filed in triplicate by every withholding agent (WA)/payor who is either an individual or non .Less: Taxable compensation not subject to withholding tax (for employees, other .

Less: Taxable compensation not subject to withholding tax (for employees, other than MWEs, receiving P250,000 and below for the year) 24. Net Taxable Compensation.BIR Form 1601C is the monthly tax return for employers who withhold tax on compensation of their employees. Learn what is compensation, how to comput.what is 1601c BIR Form 1601C is a document that businesses in the Philippines need to file every month to report and pay taxes withheld from their employees' .Form 1601-C or Monthly Remittance Return of Income Taxes Withheld on Compensation is filed by a Withholding Agent who deducts and withhold taxes on compensation paid to employees. Related Articles: .

In a nutshell, what is BIR Form 1601-C? It is called the “Monthly Remittance Return of Income Taxes Withheld on Compensation.” When you fill out this form, your business basically .

In a nutshell, what is BIR Form 1601-C? It is called the “Monthly Remittance Return of Income Taxes Withheld on Compensation.” When you fill out this form, your business basically .what is 1601c BIR Form No. 1601 In a nutshell, what is BIR Form 1601-C? It is called the “Monthly Remittance Return of Income Taxes Withheld on Compensation.” When you fill out this form, your business basically .1601C (Monthly Remittance Return of Income Taxes Withheld on Compensation) - Deadlines: For manual filer: For the months of January to November - on or before the .What is it? Form 1601-C, or Monthly Remittance Return of Income Taxes Withheld on Compensation, is filed by employers when they withhold or remove the applicable . BIR Form 1601C is a monthly tax return for employers who withhold income tax from their employees' salaries. Taxumo helps you enter, compute, and file your 1601C forms online with less .Adding Employees and Compensations for 1601C. This section will help you on adding compensation (s) for employees in your 1601-C form. Written by Maui Banag. Updated .

To those who don’t know what BIR Form 1601C is, it’s a form you have to file each month when you have employees. And the exact name the BIR gave this form is the Monthly Remittance Return .BIR Form No. 1601 ON NOVEMBER 27, 2020, the Bureau of Internal Revenue (BIR) issued Revenue Memorandum Circular (RMC) 125-2020 to inform the public on the availability of the new BIR Form 1601-C (Monthly Return of Income Taxes Withheld on Compensation) January 2018 (ENCS) in the Electronic and Payment System (eFPS).

The BIR 1601-C is called the "Monthly Remittance Return of Income Taxes Withheld on Compensation.”. You summarise your company's payroll and accounting software computation. The best part is no names or individual pay data are displayed. Philippine law mentions that you can break the components into taxable and non-taxable classifications. The BIR has released its new form on the remittance of monthly withholding taxes on compensation last November 2020 - the new BIR Form 1601-C (with a dash). .

Take note that each time a salary is given, you should input it as a salary expense under the Compensation tab. So it follows that if you release salaries semi-monthly, then that's two salary expenses in the Compensation tab per employee. Additionally, you should categorize each salary expense as semi-monthly!

1 Every time a tax payment or penalty is due or an advance payment is made; 2. Upon receipt of a demand letter / assessment notice and/or collection letter from the BIR; and. 3. Upon payment of annual registration fee for a new business and for renewals on or before January 31 of every year. BIR Form No. 0611-A.

Running a business does not only equate in earning profits and giving satisfaction to the market. Instead, there is also an inherent obligation to their employees and to the government. That is why Bureau of Internal Revenue (BIR) designed BIR Form 1601-c or Monthly Remittance Return of Income Taxes Withheld on Compensation wherein it .For members of the Philippine Bar (individual practitioners, members of GPPs): b.1 Taxpayer Identification Number (TIN); and. b.2 Attorney’s Roll Number or Accreditation Number, if any. Box No. 1 refers to transaction period and not the date of filing this return. The last 3 digits of the 12-digit TIN refers to the branch code.

Kanilang compilation sa pinay viral scandal - Sarappinay provides the latest pinay sex videos and pinay sex scandals. Watch the latest kantutan videos online here.

what is 1601c|BIR Form No. 1601